Modernize Your Mortgage Process With the Best All-in-One Digital Loan Platform

Close loans faster, reduce compliance risks, and delight borrowers with a fully integrated digital mortgage experience. Our platform streamlines every step—from application to submission—with built-in LoanApp360 and seamless LOS integrations.

Everything You Need To Simplify Transactions and Accelerate Closings

A secure and compliant platform to digitize loan files, track progress, and reduce manual tasks.

Transaction Management

E-Signature

Borrower Point-of-Sale

Communication & Compliance

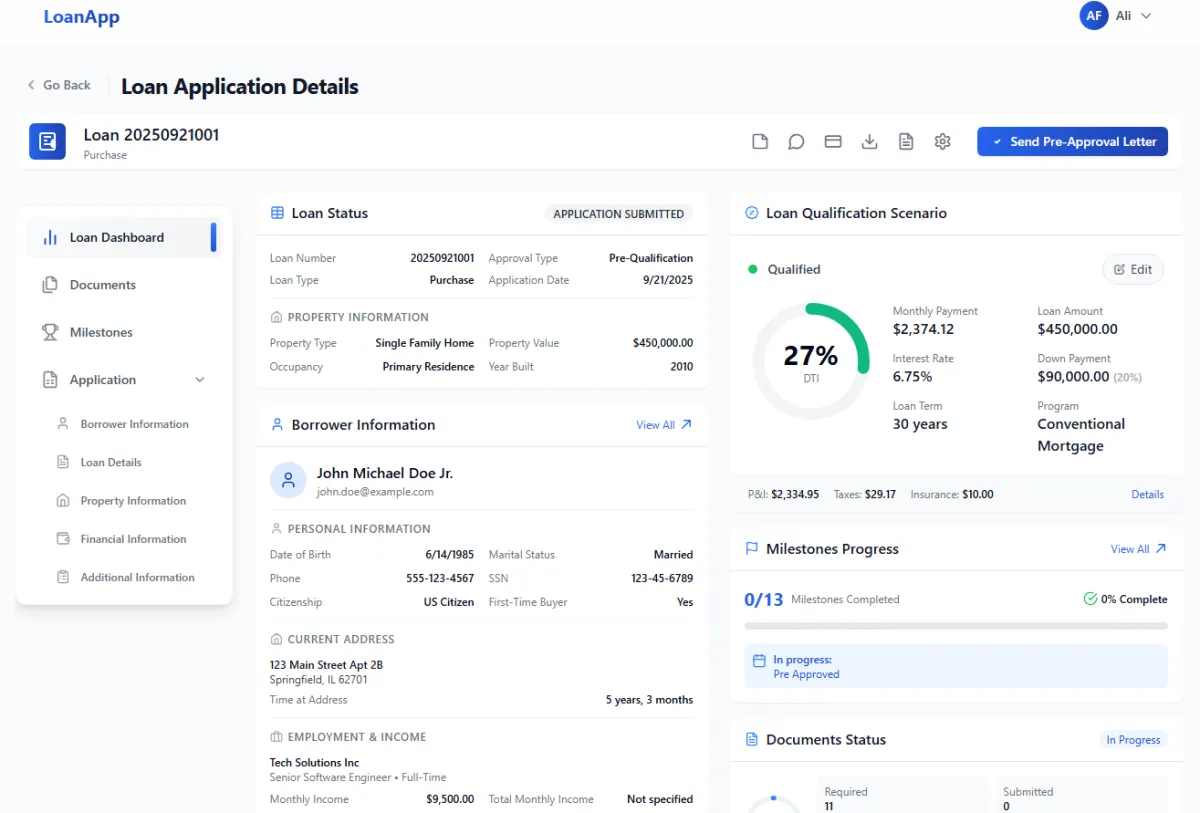

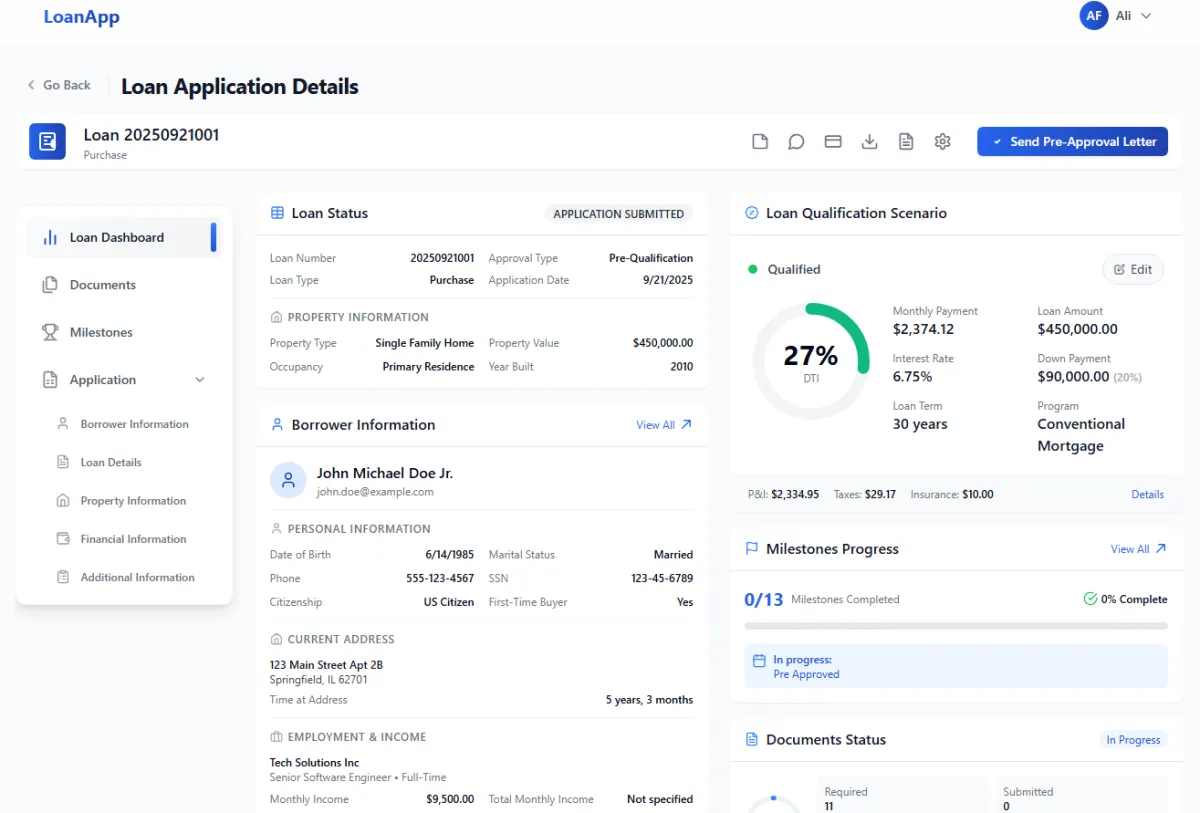

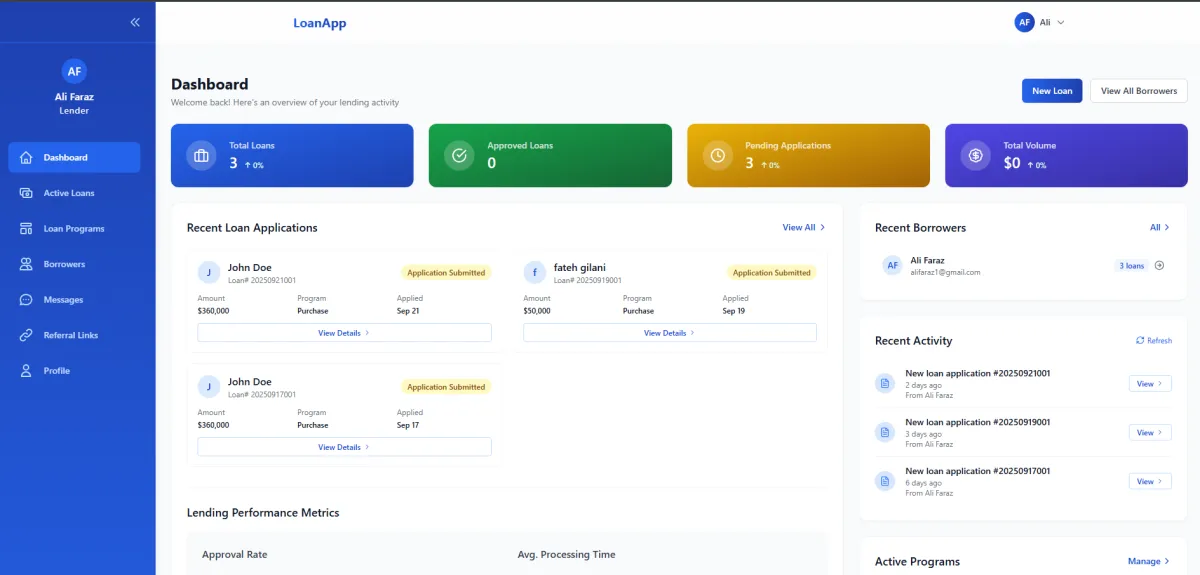

Intuitive Loan Application Portal (POS/LOS)

Our easy-to-use dashboard helps mortgage professionals manage active loans, tasks, and compliance in one centralized view. Gain instant visibility into pipeline progress and keep everyone aligned.

Dashboard & Snapshot View: See all active loan files, document statuses, and borrower milestones at a glance.

Quick Access & Audit Trail: Instantly open relevant files or communications. Full visibility into all actions for compliance and transparency.

Task & Deadline Tracker: Assign, monitor, and automate tasks with due dates for both loan officers and borrowers, so nothing falls through the cracks.

E-Signature & File Management

No more chasing paperwork or scanning PDFs. Send, sign, and store everything digitally—securely and effortlessly.

Integrated E-Sign: Secure, end-to-end digital signatures for all application and disclosure documents—no printing or scanning required.

Smart Document Storage: Upload, review, and organize all application files in a secure digital vault.

Borrower Point-of-Sale with LoanApp360

Streamline the borrower experience with a mobile-first loan application directly embedded on your website. This digital 1003 solution empowers clients and accelerates intake.

Digital 1003 POS: Homebuyers and refinancers complete the universal loan application directly from your website using LoanApp360—the gold standard for digital mortgage intake.

Exportable XML File: Completed 1003s instantly export to MISMO 3.4 XML or FNM/Freddie formats, compatible with any lender or LOS for frictionless loan submission.

Pull Credit & Liabilities: Integrated credit pull and liability population so officers and borrowers can see everything needed on one dashboard.

Mobile-First Experience: Borrowers can apply, upload documents, and e-sign right from their phone or desktop.

Communication & Compliance

Automate notifications, reminders, and disclosures with full regulatory oversight. Keep everyone informed—without the manual follow-up.

Automated Communications: Send updates, disclosures, reminders, or ‘needs lists’ through email/SMS from inside the portal, keeping everyone on track.

Compliant Audit Trail: Every action, e-signature, and document upload is tracked for complete regulatory compliance.

Why Choose Syncly360 for Digital Mortgages?

We bring together everything a modern mortgage team needs—built for speed, transparency, and borrower satisfaction.

Our digital transaction portal, powered by LoanApp360, offers a simple online loan application (1003), instant document uploads, secure e-signatures, and automatic compliance tracking. Submit directly to any lender as XML—no double entry or missed paperwork. Enjoy a modern, intuitive digital experience from inquiry to closing, on any device.

All-in-One Digital Portal

Manage docs, deadlines, POS & audits in one place

Built-in E-Signatures

No printing, no scanning—just click to sign

Fully Integrated LoanApp360

Embed loan app directly on your site

Real-Time Task Tracking

Assign, automate, and never miss a deadline

Compliant by Design

Full logs, secure file handling, and regulatory support

Trusted by Lenders

Easy export to any LOS or lender in standard XML

Ready to Simplify Your Digital Loan Process?

Join mortgage professionals nationwide who are transforming how they close loans—with less friction and more speed.

Modernize your mortgage process with a secure, digital transaction management platform. Our portal combines document tracking, e-signatures, deadline monitoring, and a powerful borrower point-of-sale, fully integrated with LoanApp360—a universal digital 1003 solution. We also have the ability to integrate with ARIVE, and other LOS systems!

Follow Us

TICKET SUPPORT

legal

© Syncly360 2026.

All Rights Reserved

333 University Avenue, Ste 200, Sacramento CA 95825